The harsh reality of first-time investing? A maze of financial jargon, overwhelming data, and confusing choices that leave potential investors stuck at the starting line.

Early concept sketching.

The Aspiring Wealth Builder

Financially responsible but investment-inexperienced looking to build long-term wealth. They're overwhelmed by investment product choices, unsure what risk level matches their comfort zone, can't decode if fees and returns are "good" or "bad" and are worried about making an irreversible mistake.

Rather than drowning in percentages, users see clear potential outcomes at different investment levels, with intuitive risk scores explained in everyday language they can relate to.

Making choices becomes intuitive through smart comparison tools. Interactive features let users view funds side-by-side, with potential returns displayed clearly. Fee structures and their long-term impact are explained upfront, while "Best for" scenarios help match funds to specific financial goals and situations.

The journey from decision to action is mapped out clearly. Users see a preview of the investment process, understand exact timeframes, and know what support is available at each step.

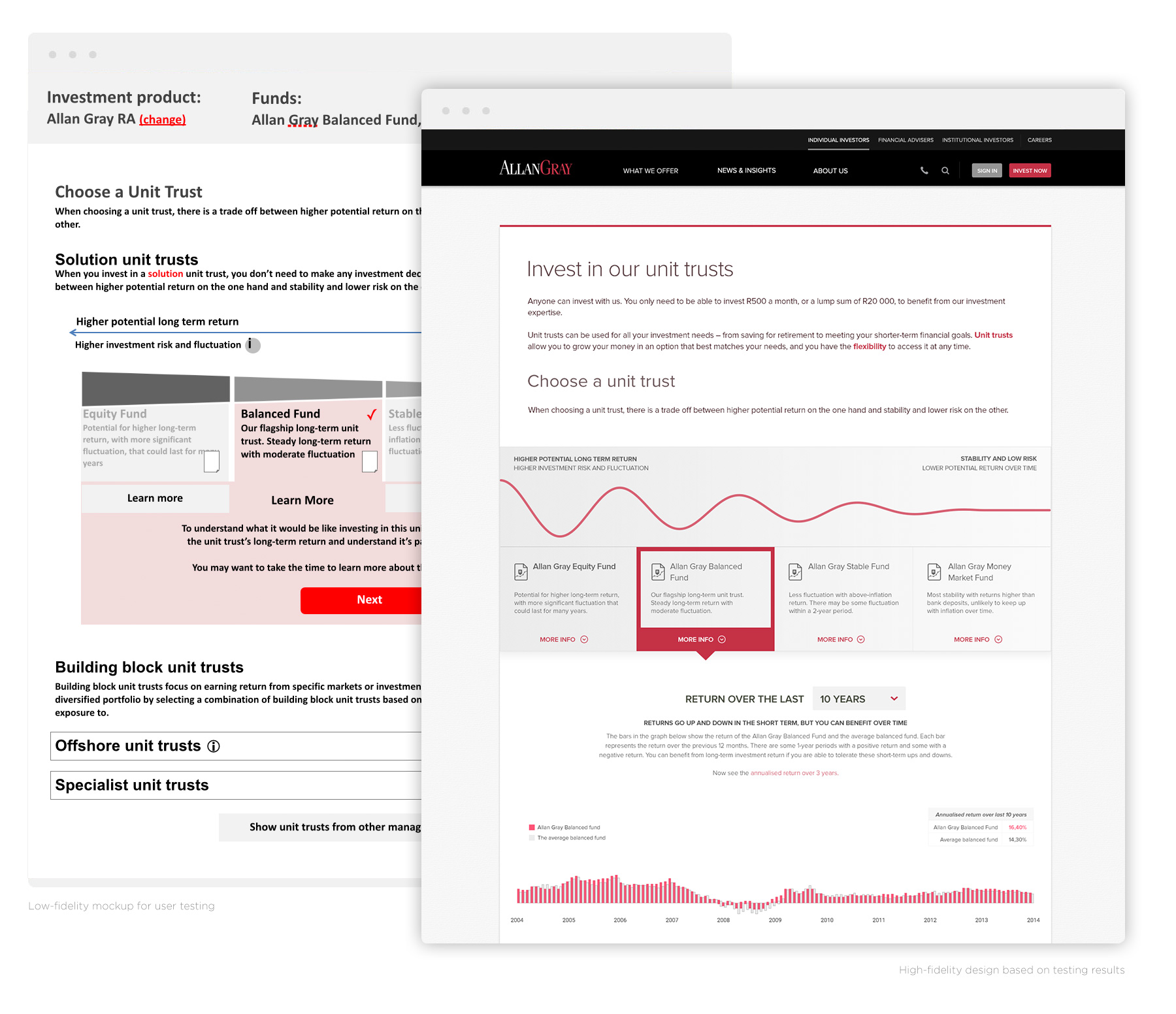

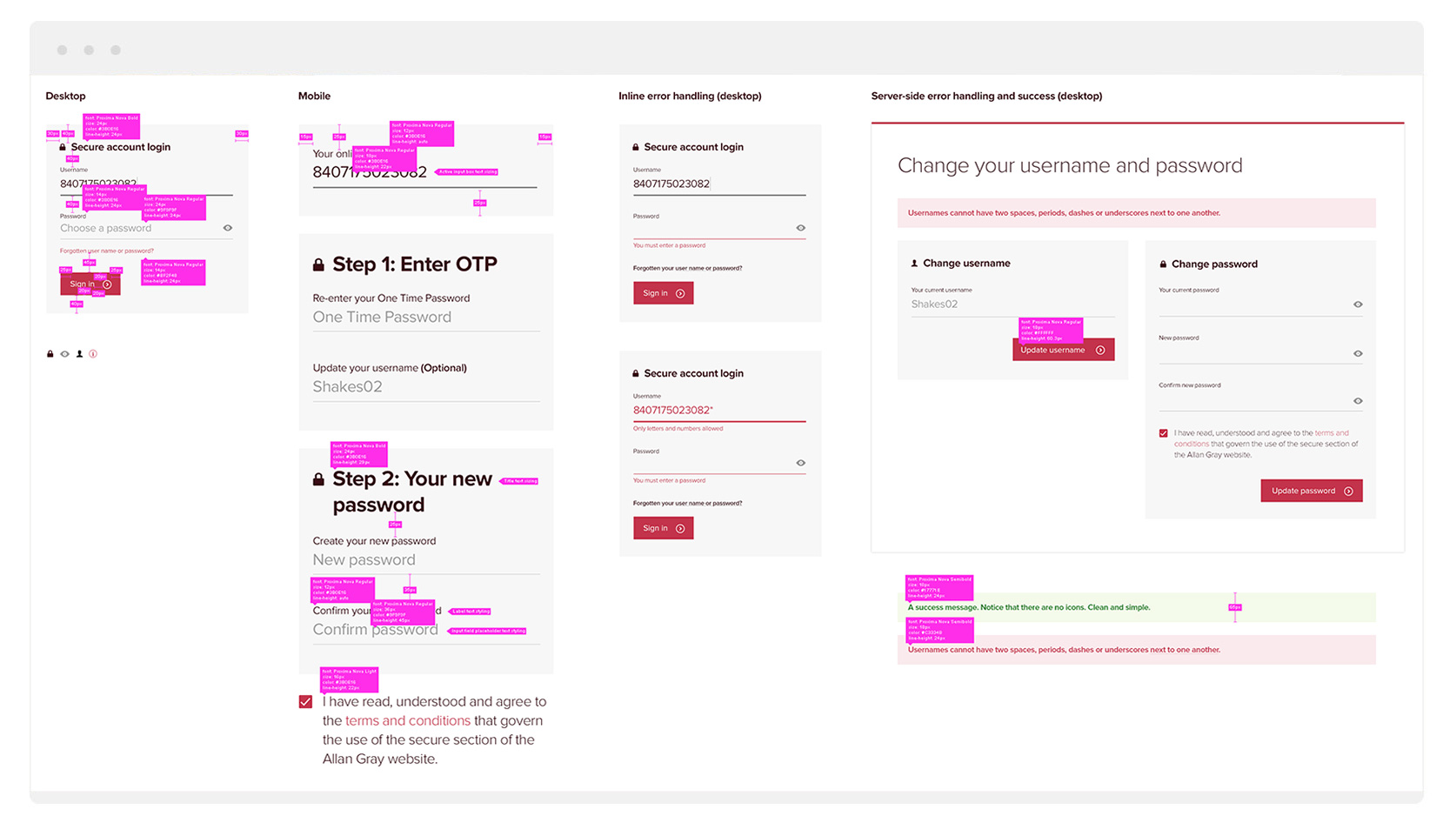

Wireframes and high fidelity mockups.

• A modern, uncluttered interface strips away complexity without sacrificing depth. Key financial metrics are transformed into visual stories that are easy to understand.

• Smart comparison tools that actually make sense. Filter funds based on your goals, risk comfort, and starting amount. See options side-by-side with visual cues highlighting key differences. Interactive sliders show how different investment amounts could grow over time, while clear breakdowns of fees and features.

• Confidence through clarity. Real-time market data and performance metrics are presented in plain language, helping users make informed decisions.

• Lower customer service costs as users self-serve through intuitive interfaces.

• Reduced drop-off during the investment consideration phase.

• Enhanced brand perception as an innovative, user-focused company.

• Higher likelihood of portfolio expansion over time.

• Stronger customer advocacy and word-of-mouth marketing.

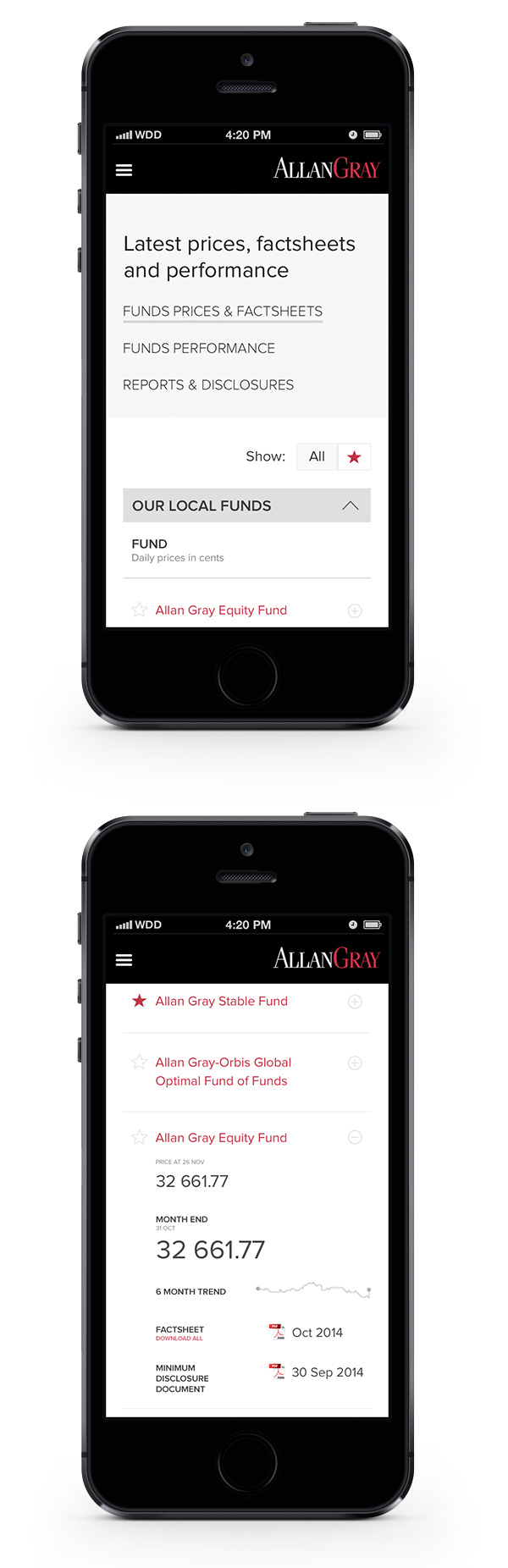

Mobile fund detail screens

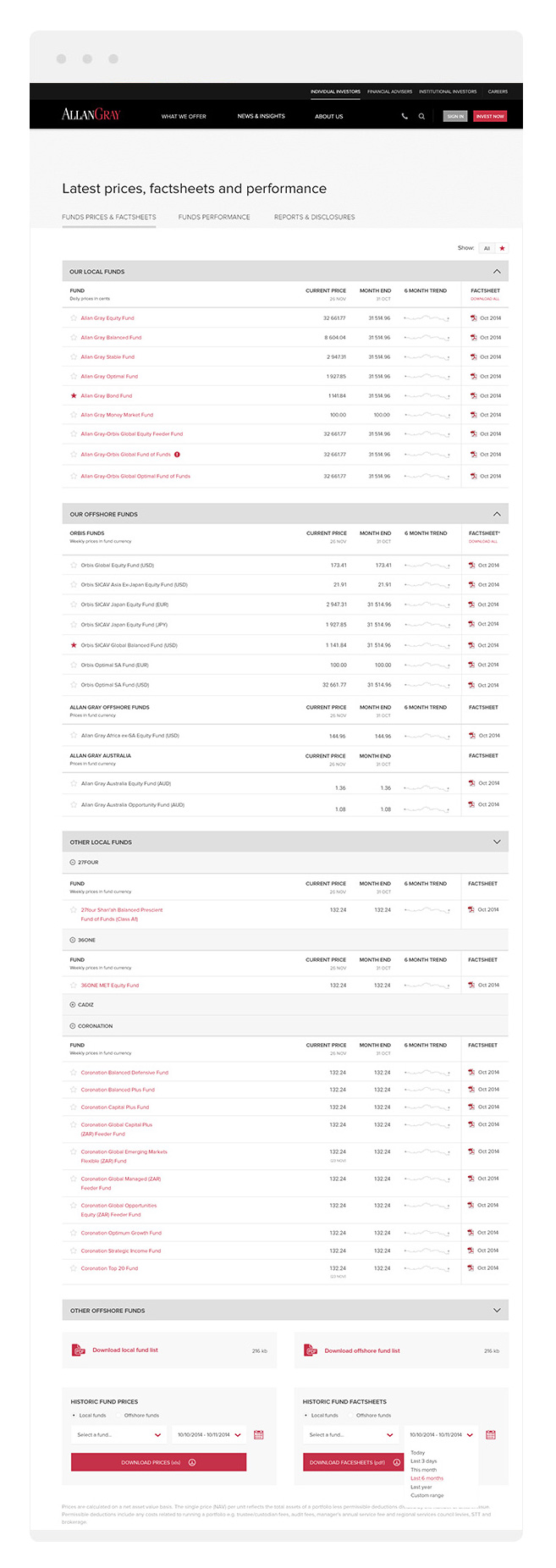

Fund facts and performance data

Engineer specs

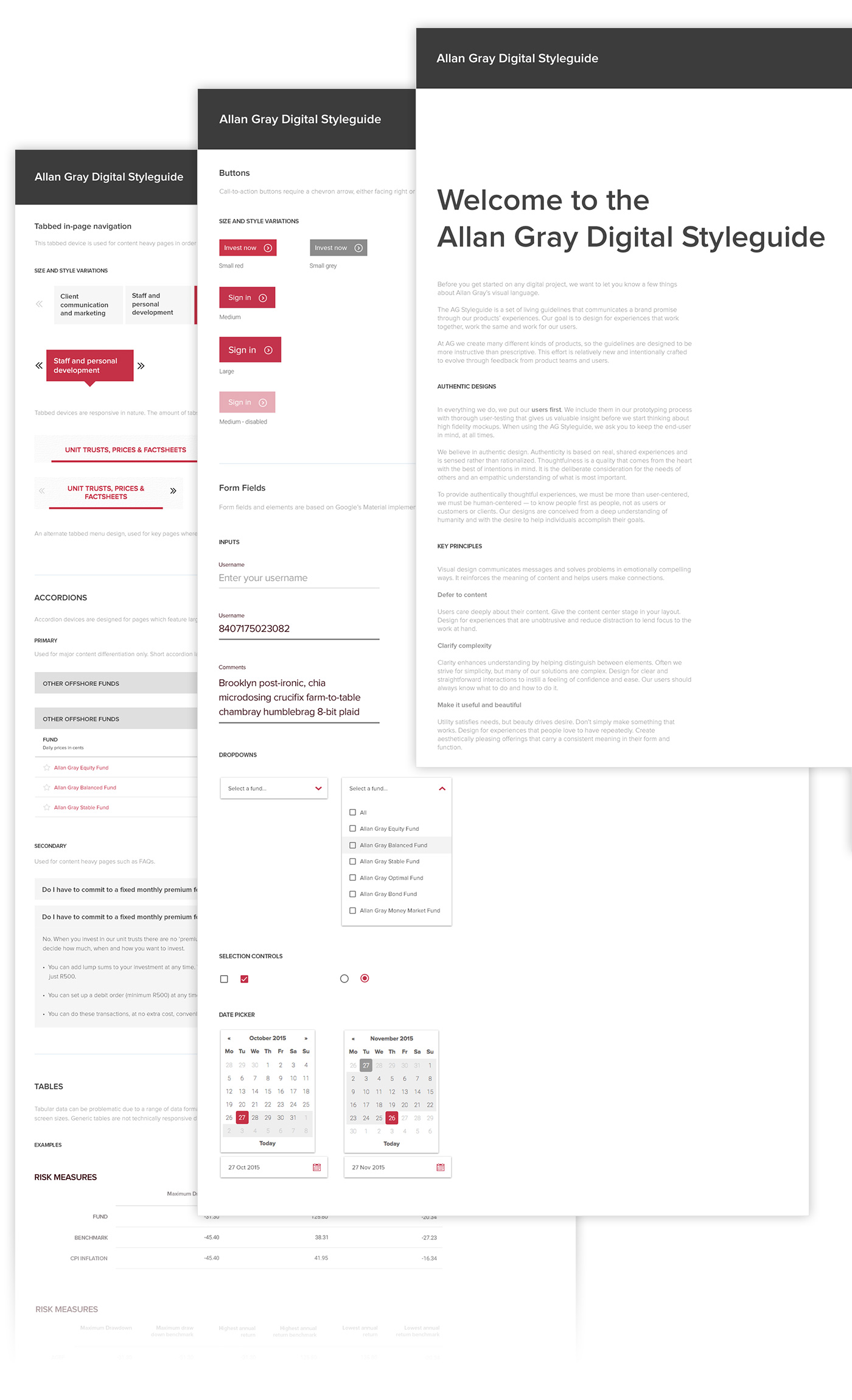

Digital styleguide screens